Successfully defying strategies of the Chinese mechanical engineering industry

European Mechanical engineering companies have served the world as a constant source of product innovation, claiming high standards in product quality, services and talents. However, these strengths have been matched, if not surpassed, by different strengths in China, the faster and cheaper competitor. Europe’s mechanical engineering companies should not underestimate the challenges, because the effects of digitalization will only augment the strengths of competitors in China.

China is now a country with the largest production for machinery and equipment, and the second largest exporter of machinery in the world. In other words, the headwind is increasing on global markets. However, China is the most important market for machines „Made in Germany” and Europe. Many European machine manufacturers will have to reposition themselves in order to maintain their future success in China: the greatest sales potential in China is in the mid-market segment. Going for high-end products alone would be extremely risky from TMG‘s point of view.

The global importance of Chinese mechanical engineering continues to grow. In 2015, China alone accounted for 38 percent of global sales of machinery and equipment. The share of EU-28 sales was 25 percent, Germany‘s share was ten percent[1]. European mechanical engineering continues to set the standard for product quality and innovation. However, in some segments, Chinese competitors have closed the gap to their European competitors. The superior competitive position of the European mechanical engineering industry is being markedly threatened.

While in the 1990s, the competitiveness of Chinese machine manufacturers was almost exclusively limited to labor-intensive low-tech productions and the low-price segments, companies are now moving more and more towards technology-intensive high-end products. Moreover, they are doing this with the consistent support from the government. The 13th five-year plan (2016-2020) and the „Made-in-China 2025“ program clearly demonstrate what medium- and long-term targets are being pursued and what development trends are emerging: China will not only continue to modernize its industry, but will also invest heavily and consistently in digitalization and networking. New information and communication technologies (ICTs) are to be more closely integrated into industrial productions; intelligent machines and products, logistics systems and operating resources are to be interlinked with each other. It is expected that because of the government’s support, national champions will emerge that will increasingly penetrate selected market segments with more superior technological quality. The players in the global machinery market are being reshuffled.

The VDMA industry association is also concerned about Beijing‘s five-year plan to develop „high-end production equipment“. According to an official statement of the VDMA from a study on „Strategies of Chinese competition and implications for German mechanical engineering“, one has to take the development „very seriously and also see the consequences for the German mechanical engineering industry“[1].

Figure 1:

Allocation of companies by product segment in China

Based on more than 300 interviews conducted in selected Chinese mechanical engineering companies, the authors of the study came to a conclusion that we fully share from our own project experience and client discussions through our presence in China: many Chinese competitors are pursuing a two-pillar strategy. They strengthen their internal innovation power within the company so as to enable their own innovation prowess and then advance to the upper market segment in the future. On the other hand, with the long-standing know-how deficits in the technological field, the companies choose to pursue a clear „Good Enough“ strategy: They supply products that are consistently tailored to customer preferences in the mid-market segment in terms of functionality, technology requirements and cost efficiency. The head of a Chinese foundry machinery manufacturer recently summed up the specific meaning of this strategy as follows: “Our goal is to deliver good quality machines – at half the price of that leading foreign manufacturers demand.”

This „Good Enough“ strategy is proving to be extremely successful for Chinese suppliers. In the mid-market segment, they have managed to assert themselves, even compared to technologically more sophisticated machines and systems from foreign manufacturers and outperform their foreign competitors.

In the high-end segment, the threat has not yet become quite as serious: for the majority of Chinese suppliers, the technology gap is still too wide to be considered a serious competitor on a large scale in the near future. However, this means that even if domestic manufacturers are catching up more and more with Western technology in terms of quality, China will still have to import high-end machines in the coming years. European machine manufacturers are therefore well advised to analyze precisely how they will have to position themselves strategically in the future in order, on the one hand, to maintain their position in the high-end segment and, at the same time, to gain a successful foothold, and to expand in the fast-growing mid-market segment.

The current performance and competitiveness of Chinese machine manufacturers

The Chinese mechanical engineering industry has considerably enhanced its competitiveness during the last decade and become now one of the most important competitors of Western companies. On a global scale, this development is reflected in the ability of Chinese companies to gain market shares abroad, as foreign trade performance is often used as an indicator of an industry‘s overall performance. It also includes initial statements on the technological performance of this industry, mostly with regard to the R&D intensity of exports. Internationally, China is not only the largest producer but also the second largest exporter of machinery. Overall, China‘s contribution to global mechanical engineering sales rose to 38 percent in 2015, a remarkable increase compared with eleven only eleven percent in 2006[1]. China‘s share of world machine exports rose by 2.7 percent in 2014 from its 2013 level, arriving at 12.5 percent. Germany took first place with a share of 16.1 percent. U.S.A. increased its share by 10.8 percent, finishing third with 11.2 percent, followed by Japan and Italy[2]. According to the Chinese survey of mechanical engineering, a total of 82,016 enterprises of a certain size or more existed in 2014, representing 21 percent of all industrial enterprises. Mechanical engineering companies contributed 20.4 percent to sales and 24 percent to profits of this industrial sector. At approximately ten percent, the earnings growth of mechanical engineering companies was significantly higher than the average for other industrial companies (at 3.35 percent only). Investments in mechanical engineering represented around nine percent of all investments in the industrial sector.

In addition to globalization and specific government support, the main drivers behind China‘s successful economic development are urbanization, rising income levels and strong growth in the domestic demand. Manufacturers of foundry machinery, for example, are currently advancing greatly from the automotive industry and its efforts to reduce vehicle weight. In the case of manufacturers of wood-processing machinery, it is primarily the construction industry with an abundance of refurbishment measures and the growth of the real estate market, which are driving the development of mechanical engineering. A number of other factors support the rise of the Chinese mechanical engineering industry, e.g., a relatively well-developed infrastructure, an established supplier network, and in particular the technology transfer by foreign companies.

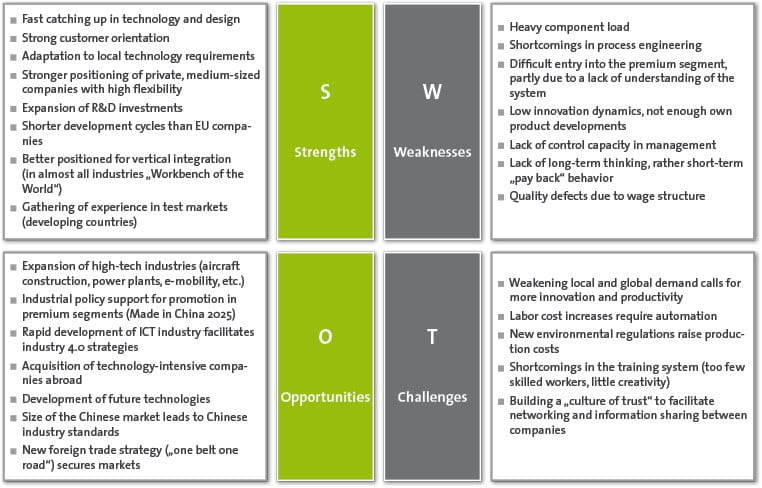

Figure 2 summarizes our experience with the competitiveness and technological performance of Chinese mechanical engineering companies.

Figure 2: SWOT analysis on the competitiveness and technological performance of Chinese mechanical engineering companies

Strategies of Chinese machinery manufacturers

China owes its leading market position in the mid-market segment primarily to its combination of state-sponsored innovation efforts, the integration of foreign components and technologies and consistent customer orientation. The „Good Enough“ strategy pursued in the domestic mid-tech market offers the companies abundant opportunities to grow profitably in a familiar segment – both in the core market of China and in export markets. Figure 3 shows which strategies Chinese machine manufacturers are pursuing in selected, from our point of view particularly important fields of action.

Accordingly, it is a priority to continue to grow strongly in the domestic market and, in particular, to further expand its position in the mid-market segment. This strategy is implemented through targeted support programs, know-how transfer, and in-house developments (e. g. local basic machines in combination with imported key components)[1].

From the Chinese suppliers‘ point of view, service is also extremely important. Chinese machinery continue to have a reputation for their less desirable quality. This is one of the reasons why Chinese machinery manufacturers are doing everything they can to offer a much better service than the suppliers of imported machinery. Ultimately, the strategy of local suppliers is to compensate for qualitative deficiencies in their products through extreme responsiveness, low service costs, and excellent local customer services. Instead of striving for high margins in the after-sales business, Chinese suppliers consider service as an „added value“ for the customer and an excellent means of generating follow-up business from close contact with the customer. The result is to differentiate themselves from competitors on a sustained basis.

Figure 3: Strategic focus of Chinese machine manufacturers in selected fields of action

It is equally important for companies to take the next step forward in production. The „performance gap“ to German machinery manufacturers has become significantly narrowed –owing partly to the steep learning curve that Chinese competitors have undergone in recent years, partly to the increased usage of higher quality machines in their production. However, there are still major deficiencies in the areas of quality control and assembly: very few Chinese companies are in a position to implement a stable assembly process. What we can currently see is that more and more companies are turning to lean production concepts in an effort to catch up with Western

production technology. In connection with the gradual adoption of BPM approaches („Business Process Management“), controls are to be improved in each process step and tangible or sustainably effective quality improvements are to be implemented.

In order to ensure the professional implementation of these new processes, Chinese providers are increasingly consulting foreign experts. As a countermeasure to the sharp rise in wage and labor costs, some companies also consider outsourcing non-critical processes or taking the next step towards fully automated assembly.

For some time now, the topic of „internationalization“ has also been a top priority on the agenda of Chinese machine manufacturers’ management team. Building on its strong foothold in the domestic mid-end market, machinery manufacturers from China are ever increasingly expanding their exports of „Good Enough“ machines. This way they can mainly target the emerging markets. Chinese mechanical engineering companies are pursuing a „two-wave“ strategy in their internationalization efforts: until 2015, the focus was on the Southeast Asian countries: the SEA states of Thailand, Indonesia, Vietnam, Malaysia, and India. All the countries of this first wave were ideally suited to Chinese machinery in the low and mid-range segments primarily due to their local customer requirements in terms of price and quality, as well as geographical proximity, similarity of the markets and the high level of acceptance that Chinese suppliers enjoy among these customers. In addition to the SEA states, companies in the first wave also addressed South America, Africa and Russia.

In a second wave starting in 2015, Chinese suppliers have been trying to gain a foothold in the developed countries of Europe and the U.S.A. with higher quality and high-end products. They are becoming increasingly better at what they are doing. Nevertheless, despite undeniable progress in terms of quality and price competitiveness, Chinese suppliers still enjoy a reputation for manufacturing products of inferior quality. Another serious limitation is the lack of access to international labor markets and to appropriately trained professional staff. All the above greatly hinders or hampers the establishment of an international service network.

The aforementioned deficits are to be partially eliminated through mergers and acquisitions. We expect that the further rise of Chinese machinery manufacturers will be accompanied by a series of acquisitions and mergers in the mid-market segment. German companies present a particularly attractive target for Chinese investors – above all because of their excellently trained staff, highly developed technologies, and brand equities.

From the Chinese suppliers‘ perspective, there are several motives for the cross-border acquisitions: from obtaining advanced technology and much needed R&D capacities, as well as access to highly qualified, experienced employees, it allows them to capitalize on the brand equity of the acquired companies to expand their own reputation worldwide and to break into new market segments.

Strategic challenges for German and European machine manufacturers

From the analysis of the selected strategic elements, we have come to an essential conclusion: Chinese manufacturers are increasingly becoming bona fide competitors for traditional European mechanical engineering. Based on our observations, we can only urge European machinery manufacturers to take developments in China very seriously and to equip themselves against Asian competitors with apt strategies.

In addition, the progressing digitalization raises doubts if traditional business models will continue to deliver value in the future. The ever-increasing complexity of products and solutions, coupled with ever-shorter product lifecycles, intensifies the pressure on earnings and demands much greater agility and flexibility in production and development.

Chinese competitors attack mainly via pricing and a shorter „time to market“. On the part of the American competitors, the local mechanical engineering industry is coming under pressure above all through new and creative business models. More and more companies therefore have to ask themselves whether they are still in the right position to face the new challenges and the market development dynamics.

Undoubtedly, the traditional engineering skills remain fundamentally important. However, in order to maintain a successful position under the new market conditions, additional competencies and skills are needed.

But what can European mechanical engineering companies do to survive the battle against the increasingly fierce competition and even to benefit from the rise of the Chinese mechanical engineering industry?

The German and European mechanical engineering companies’ future success in China depends on their own strengths and weaknesses, as well as the further development of the Chinese market. Indeed, the economic momentum in China has slowed down. Nonetheless, as a consumer market, China nevertheless remains attractive with a market volume of 66bn EUR in the medium and long term, as there are still a lot of areas needing further improvement.

We believe that the realignment of the economic model towards a more consumer-oriented development, greater sustainability and more environmental protection will contribute to the growth of the Chinese market, resulting in additional opportunities in the future. Finally, yet importantly, the „Made in China 2025“ program will further escalate China’s attractiveness as a sales market and geographic location. We are convinced that China will retain its pivotal importance for the European mechanical engineering industry and remain the most important export market from a strategic point of view. Again, the greatest growth potential lies in the mid-market segment.

Figure 4: SWOT analysis of European mechanical engineering companies in China

The SWOT presentation in Figure 4 presents how we assess the current strengths and weaknesses of European mechanical engineering companies in the Chinese market based on our own evaluation gained from project work and client discussions and what opportunities and major challenges are associated with them.

In order to secure its market leadership in the high-end segment and simultaneously gain a successful foothold in the attractive mid-range segment, the European mechanical engineering industry will need to design product offerings precisely tailored to the technical specifications and price expectations of the local customers. The basic prerequisite to this end is the expansion of local R&D activities.

Furthermore, it is urgently recommended to check Chinese plants regularly for cost optimization opportunities and critically analyze procurement activities. Another equally important task is to develop specific sales and distribution strategies for the Western regions of China, where many of the Tier II/III cities are located.

Additionally, existing technological advantages and excellent brand reputation should be promoted more vigorously than before. In the mid-market segment, intelligent service concepts, fast response times, and cost-efficient maintenance and spare parts delivery are also considered very important. The necessary customer proximity can be guaranteed by means of special service bases, which are operated either together with other European machine manufacturers or in cooperation with local partners or specialized service providers. It is critical to position oneself in such a way local services can be rendered faster and at competitive prices in the future.

Moreover, digitalization intensity makes it a mandatory task for companies to increase their digitalization prowess, so as to enable the realization of the greatest possible benefit from the unlimited possibilities of digitalization. In other words, each company’s activities must be re-prioritized in line with the new framework. We also need to keep in mind that when business models change, profitability will come under pressure during the initial phase.

In order to make the best possible use of the business opportunities arising from the new framework, we believe it is imperative that those responsible in mechanical engineering companies pause for a brief moment and reconsider their strategies for the next five years:

- Are the growth and profit expectations assumed in the current strategy still realistic from today‘s perspective? How can you profit from the changing growth patterns (geographically or along the value chain, e.g. from production to services)?

- How does digitalization affect the business model and production? What kind of digitalization roadmap must be designed to fundamentally improve efficiency, to achieve cost reductions in the order of 5 to 10 percent by 2020, as well as to achieve economic benefits from new digital business models, e.g.to achieve a revenue share of around 10 percent by 2020?

- Where in the organization are there still weaknesses with regard to new growth prospects and ongoing digitalization? What organizational change should result from the previous questions?

Figure 5: Proposed field of actions for European machinery companies along the strategic topics: growth, digitalization and organizational changes

Every company must find its own answers to these and similar questions. The following picture outlines an exemplary action plan that can serve as a starting point for decision-makers in European mechanical engineering companies when developing their agenda along these strategic issues. The success story of the European mechanical engineering industry has been relying on high-quality, innovative and export-oriented products in the premium segment. This orientation should remain the core of the business model in the coming years. However, this positioning alone will not be sufficient to maintain sustainable future success. The unprecedented dynamics of change and the degree of digitalization are creating a new economic framework, and the speed is breathtaking. As a consequence, the sustainability of traditional business models is questionable.

In order to keep pace with the developmental dynamics, many companies in mechanical engineering will have to reposition themselves. The road to a successful future can only be envisioned in three words: innovation, digitalization and diversification.

By Timo Wiegmann

Read the PDF version here.

By Timo Wiegmann

Dr. Timo Wiegmann has been serving as the Managing Director at TMG Consultants (Shanghai) for the past 14 years. TMG Consultants pride themselves on being the premier partner for the manufacturing industry, with an aspiration to improve the world of production. Tackling key issues of the manufacturing industry, constantly focusing on the topics that matter to you, they aim to serve as competent partner for the top management to develop far-sighted strategies and sustainable solutions.

Dr. Wiegmann’s Industry Expertise furthermore comprises of Manufacturing, Automotive and Process industry, with functional competencies in developing corporate & functional strategies; global production footprint strategies; Business development; Execute commercial & technical due diligence projects; Execute restructuring & re-organizational projects; Factory planning & realization, among many others.

Connect with him on LinkedIn.