Productivity Management: An Essential Capability for Maximizing the Value of Operational Excellence

Operational Excellence (OpEx) is a term that embodies many things that CEOs seek to achieve, such as consistent strategy execution, profitable growth and sustainable cost reduction. While there are many definitions of the term, most would agree that it entails focusing on customers, cross functional execution and consistent delivery of outcomes that create value for customers and shareholders. Whatever label is applied to these aspirations, organizations frequently fall short of fully achieving them. Especially in global organizations that exhibit the complexity characteristics shown below in Exhibit 1.

Exhibit 1: Complexity Characteristics – As the number of complexity characteristics increase, Operational Excellence programs (and global organizations as a whole) are likely to be affected by complexity-related challenges.

- Large Scale: Many products, brands, services, customers, employees, vendors, purchased parts & commodities

- Variability: In demand volume, product & customer mix, inventory & service levels, product pricing & input costs

- Rapid Change: To products, suppliers, services, processes, projects, operational constraints, organization structures

- Organization Structure: Multiple legal entities, Business Units (BUs) , Shared Services and geographies

- Interdependence: BUs share customers, suppliers, production and back office services, thereby obscuring profit drivers

- Globalization: Strategies deployed through supply chains that cut across multiple entities

Why is it difficult for organizations to realize these aspirations? One reason is the persistence of functional silos. Not only do they undermine strategy and impede change, they erode value by causing dissatisfied customers, lost revenue and bloated cost structures. As shown in Exhibit 2, functional silos – not data silos – are one of the top barriers to achieving common business objectives, according to recent research studies.

Exhibit 2: Out of 28 research studies, 27 (or 97%) ranked functional silos as one of the top 3 barriers to achieving key business objectives. Of these 17 (or 61%) identified silos as the top barrier, while 36% ranked it as the 2nd or 3rd barrier.

Alignment Paradox

These are classic examples of “horizontally-based” business objectives and initiatives. What’s common to them is that their success and value is based on improving cross-functional outcomes, horizontally across functions and entities. The problem is that organizations don’t plan, manage and govern this way. Rewards and decision rights typically follow functionally based budgeting and reporting processes. As a result, these “vertically-based” financial processes can be at odds with “horizontally-based” strategies. This is the “alignment paradox” facing OpEx leaders.

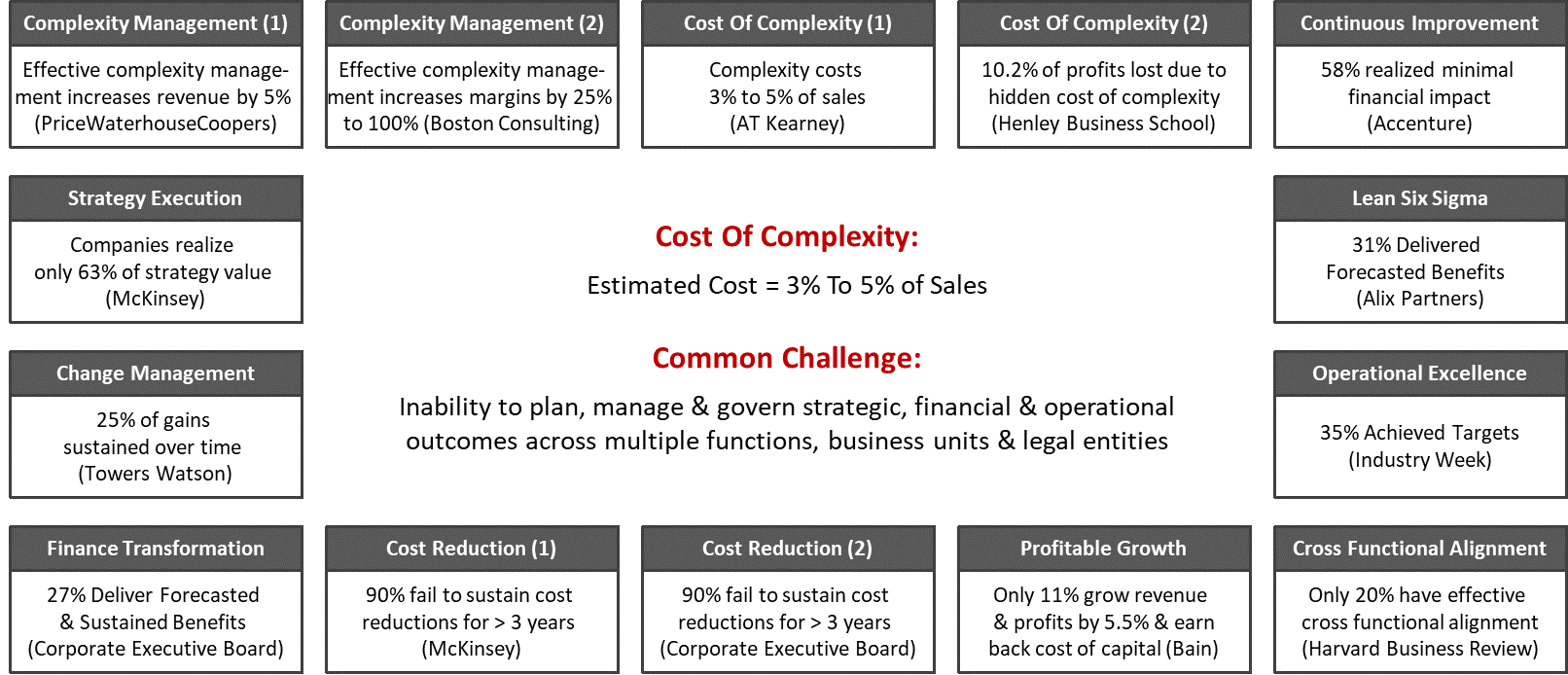

The net result of this alignment paradox is that it reinforces functional silos and erodes value. Moreover, it’s a pervasive problem that erodes value in different ways, as illustrated below in Exhibit 3. Collectively, these sources of value erosion comprise the cost of complexity, an amount that can reach upwards of 5% of sales.

Exhibit 3: Cost Of Complexity – One factor is common to the value erosion illustrated by the research study results shown below: that being an inability to plan, manage and govern outcomes in complex business environment.

These different forms of value erosion all stem from one common challenge. That being, an inability to plan, manage and govern (strategic, financial and operational) outcomes, across multiple functions, business units and legal entities. And it’s a challenge that’s becoming increasingly relevant to finance executives, as well as OpEx ones.

Finance Expectations

Why is the challenge relevant to finance executives? Because many are now expected to play more strategic roles – ones that maintain competitive cost structures, while also shaping and executing strategies that create profitable growth. In other words, they are expected to be value creators, not bean counters.

However, they must play this new role, while also continuing to fulfill traditional fiduciary responsibilities, such as regulatory reporting and taxation. Therefore, replacing vertical budgeting and reporting processes is not an option! So any solution to this alignment paradox must support both roles. This is the nature of the solution presented below.

Enterprise Productivity Management

One way of supporting both these roles is with enterprise productivity management – a method for managing how effectively organizations produce key business outcomes, examples of which are provided below:

- New & retained customers that are ready to buy

- Completed orders that meet customer expectations

- Positions that are staffed with motivated and capable people

- Suppliers that are capable of providing quality products when needed

- Available products that meet customer quality and service level expectations

These examples also illustrate what productivity management is not. That being a method for managing the efficiency of individual functions, activities and tasks. Rather, it entails a broader and more strategic perspective that focus on key factors that drive business value. It has four key benefits, which are illustrated in Exhibit 4, described in detail below and summarized as follows:

- Improve transparency by way of a productivity management framework

- Drive OpEx and cost reduction, with readily available and accurate process cost data

- Break down functional silos by managing key tradeoffs that govern enterprise performance

- Align employees around value optimization a establishing shared rewards based on managing key tradeoffs.

Exhibit 4: Productivity Management Capabilities – Three productivity management capabilities play a central role in helping organizations to more effectively manage functional silos.

The first benefit is greater performance transparency. One that is rooted in a deeper and shared understanding of the economics of the business. Productivity metrics can be decomposed from top to bottom using a framework like the one illustrated in Exhibit 4.1. For example, for the “Order to Cash” process, “cost per order” can be decomposed down to “cost per pick”, for high, medium and low volume inventory (or A,B & C) items. What’s more, these productivity metrics can be managed by product, customer and segment, across legal entities.

The second benefit is that the organizations can more effectively drive continuous improvement and cost reduction. This is because they have readily available access to accurate business process and activity costs. This is achieved with a cost matrix (illustrated in Exhibit 4.2) that reconciles functional (i.e. chart of accounts) costs to business process and activity costs – at all times for actuals, budgets and forecasts. Not only can organizations track cost reduction efforts, but they’ll have an ongoing inventory of cost reduction opportunities.

The third benefit relates to breaking down functional silos. This is a achieved by focusing people on key tradeoffs for all business processes and the activities that comprise them. For example, in an order to cash process (illustrated in Exhibit 4.3), the three “Tradeoff Metrics” are perfect order fulfillment, days in accounts receivable and cost per order. By focusing people on balancing these conflicting measures across functions and entities, organizations can establish a formal mechanism for optimizing business performance.

The fourth benefit pertains to value alignment. This is achieved by establishing shared rewards for managing tradeoff measures. For example, in the order to cash process, tradeoff measures are defined for component activities such as order entry, fulfillment, delivery, invoicing and collection. However, the majority of rewards are based on the ability to achieve the overall tradeoff measures. As a result, people are motivated to make decisions that optimize performance of business processes and the organization as a whole.

Fixing Rolling Forecast Processes

One additional benefit of productivity management is that it enables organizations to fix rolling forecast processes. These processes have been adopted by many organizations. Especially those that have already recognized the (well documented) pitfalls of traditional budgeting processes. But rolling forecasts don’t always deliver expected benefits because functional silos still impede resource allocation.

By eliminating functional silos, resources can move more freely between departments and entities. Moreover, when supported by mature planning models, these processes can dramatically improve scenario planning and cash flow forecasting. What’s more, the cost and cycle time of these processes can be significantly reduced.

Converging Challenges

Collectively, these productivity management capabilities provide the means to meet common needs of finance and OpEx executives. In many cases, OpEx executives are likely to identify these common needs first. In this context, they can be a catalyst to rethinking the processes that organizations use to plan, manage and govern their business. A critical first step, in this regard, is to develop a deeper understanding of:

- The process that supports both productivity management and traditional financial needs

- Why these processes could cost as much as 50% less to operate than the ones currently in use

- How these processes can reduce the cost of complexity – an amount that could reach 5% of sales

- The technologies that support these processes and the incremental capabilities they provide, compared to traditional financial planning and performance management tools

These benefits and value make productivity management an essential capability for value-focused OpEx and Finance executives. Especially in complex organizations where functional silos have undermined OpEx and other horizontally-driven initiatives. By embedding productivity management into planning and performance processes, OpEx executives can play a more prominent role in executing strategies that drive profitable growth and competitive cost structures. All while making financial functions and processes more cost effective.

By Dean Sorensen

Dean Sorensen is a management consultant with a unique mix of strategic, financial and operational experience across dozens of manufacturing companies in Consumer Products, Food and Packaged Goods, Automotive, Aerospace, Industrial Products, Chemicals, Steel and High Tech sectors. He is also an expert in integrating strategic, financial and operational planning and performance management processes, with deep experience in Integrated Business Planning and Integrated Financial Planning processes and technologies. A versatile professional that works effectively at all organization levels, from executives to front line employees, in both strategic and tactical roles. A “roll your sleeves up” change agent that can solve complex problems and lead cross functional teams, in challenging and ambiguous environments. Connect with him on LinkedIn.